Table of Contents

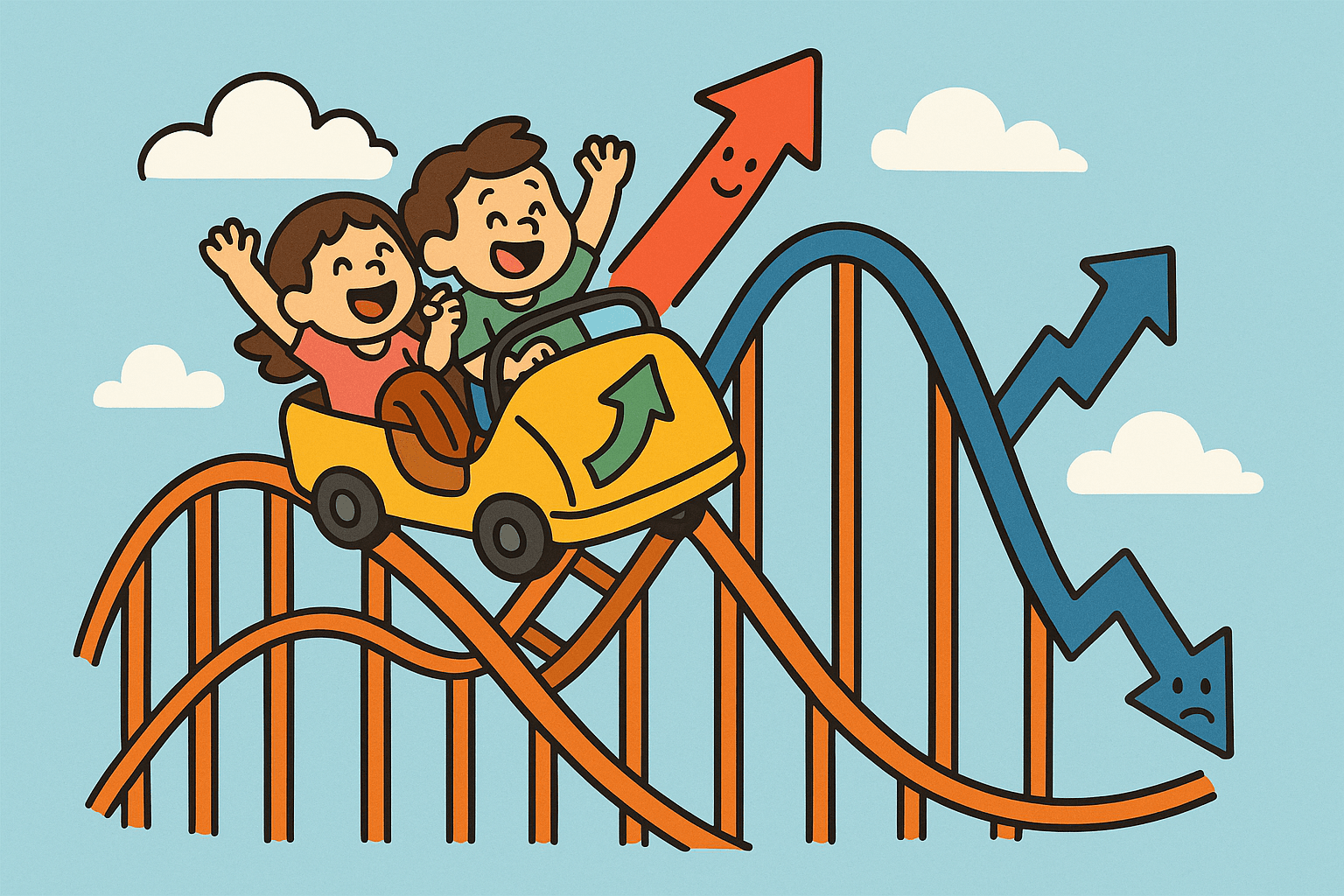

Understanding how markets rise and fall doesn’t have to be scary. In fact, when you look closely, market cycles are a lot like the seasons or the ups and downs of a roller‑coaster ride. They follow patterns of growth and decline, and even though no one can predict exactly when each stage will begin or end, we can learn to recognize the signs. This beginner‑friendly guide breaks down market cycles for readers of all ages, with examples from India and the United States and colorful cartoons to make the journey fun.

What Are Market Cycles?

Markets rarely move in a straight line. When economists talk about a market cycle or business cycle, they mean the repeated pattern of expansion and contraction that economies experience over time. The economic cycle—also called the business cycle—is the fluctuation of economic activity between periods of growth and decline. Factors such as gross domestic product (GDP), interest rates, employment and consumer spending help determine which stage the economy is currently in. These stages are predictable, but their exact timing is not investopedia.com.

Think of a market cycle like the four seasons. Just as spring brings growth and warmth, markets have phases where businesses expand and people feel confident. Summer is like the peak—the hottest point when growth hits its maximum. Autumn resembles the contraction or recession phase as growth slows and the leaves (or profits) fall. Winter represents the trough, a period when activity is at its lowest before the next spring arrives. After the trough, the cycle begins anew.

Economies across the world, whether in Ghaziabad, New Delhi, New York or San Francisco, all move through these cycles. Recognizing them helps investors and families understand why stock prices sometimes soar, why they sometimes fall and why patience and planning are essential.

The Four Phases of a Market Cycle

1. Expansion: The Spring of the Economy

The expansion phase is when the economy experiences relatively rapid growth. During expansion, interest rates tend to be low, businesses invest, production increases and employment and wages rise. The Corporate Finance Institute notes that positive economic indicators—employment, income, output and profits—climb during this stage corporatefinanceinstitute.com. GDP grows, consumer demand increases and people feel optimistic.

In India the post‑liberalization surge of the 1990s and the 2003‑2007 rally are prime examples. Strong economic growth and booming sectors like information technology and financial services pushed stock indices such as the BSE Sensex to new highs. In the United States, the recovery after the 2008 financial crisis produced one of the longest bull runs in history, lasting from 2009 to early 2020.

Signs of expansion include:

- Low interest rates: Borrowing is cheap, encouraging businesses to invest.

- Rising employment and wages: Companies hire more workers and pay increases are common.

- Growing consumer demand: People buy more goods and services.

- Higher corporate profits and stock prices: Share values often rise as businesses earn more.

2. Peak: When Growth Hits the High Point

After months or years of expansion, the economy reaches a peak. This is the moment when growth hits its maximum rate and cannot continue rising forever. During a peak, prices and economic indicators may stabilize before reversing downward. Businesses may struggle to match rising demand, production costs (including wages) increase and profits can level off britannica.com. Inflationary pressures build, and central banks often raise interest rates to prevent overheating.

In both India and the United States, peaks have preceded some famous market turns. For example, the dot‑com bubble of the late 1990s in the U.S. saw technology stock prices soar before peaking in 2000. In India, the Sensex reached a record high of 21000 in early 2008 before the global financial crisis cooled the market. Peaks remind investors that no boom lasts forever.

3. Contraction: The Economy Slows Down

The contraction phase, sometimes called a recession, follows the peak. Growth slows, employment falls and prices stagnate. Businesses may not adjust production quickly enough, leading to excess supply and downward pressure on prices investopedia.com. Corporate profits decline, consumer spending falls and investors move money into safer assets like government bonds. The Corporate Finance Institute describes this stage as a period of declining demand for goods and services, falling income and output and lower wages.

Contractions can be mild or severe. The global financial crisis of 2008 triggered a sharp contraction worldwide. In India, the crash followed the 2003‑2007 rally and led to significant market declines. In the U.S., the housing market collapse and banking failures sent stocks into a bear market, and unemployment rose sharply. More recently, the COVID‑19 pandemic caused a short but steep contraction in early 2020 as governments imposed lockdowns and consumers stayed home.

4. Trough and Recovery: Finding the Bottom

Eventually, the economy hits a trough—the low point in the cycle. Supply and demand contract to their lowest levels, creating a negative saturation point. This stage can be painful because unemployment is high and spending and income are low. However, it also sets the stage for recovery. Low prices encourage consumers to start buying again, businesses replace old equipment and invest, and governments may stimulate the economy with supportive policies. The recovery phase begins when confidence returns and the economy starts growing again britannica.com.

The 2009–2010 period in India is an example of recovery: after the 2008 crash, the Sensex rebounded as investors regained confidence. In the U.S., the recovery from the Great Depression in the 1930s and the rebound after World War II show how economies can bounce back strongly once conditions improve.

The cycle then repeats. Understanding that recovery always follows a downturn can help investors stay calm during difficult times.

Bull vs Bear Markets

You may have heard people talk about bull markets and bear markets. These animal nicknames come from the way each creature attacks: a bull thrusts its horns upward, while a bear swats its paw downward. In simple terms, a bull market is when stock prices are rising or are expected to rise by at least 20 % after a previous decline. Bull markets can last for months or years and usually occur when the economy is strong, unemployment is low and corporate profits are rising. Investors are confident and buy shares early, hoping to sell them later at higher prices mydoh.ca.

In contrast, a bear market happens when stock prices decline by at least 20 % for two months or more. Bear markets are often triggered by investor uncertainty. For example, when the COVID‑19 pandemic began in 2020, fear and uncertainty led investors around the world to sell their stocks, causing a short‑lived bear market. During bear markets, it may feel like everything is going wrong, but savvy investors often see opportunities to buy quality investments at lower prices.

Bull and Bear Markets in India and the U.S.

India

The Indian stock market has experienced several bull and bear cycles. The post‑liberalization surge of the 1990s and the 2003‑2007 rally saw the BSE Sensex climb dramatically, driven by strong economic growth and investor optimism. After these rallies came notable bear phases. The Harshad Mehta scandal in 1992 led to a market crash, as did the dot‑com bubble burst of 2000–2001 and the global financial crisis of 2008.

United States

The U.S. has also seen dramatic cycles. After the dot‑com bubble peaked in 2000, technology stocks collapsed, triggering a bear market. The longest U.S. bull market ran from 2009 until early 2020, fueled by low interest rates and steady economic growth. It ended abruptly when the COVID‑19 pandemic caused stocks to plunge. Historically, after each bear market—whether it was the 1929 crash, the 1973–74 oil crisis or the 2008 financial crisis—the market eventually recovered and began a new bull run.

How Do We Measure Market Cycles?

Economists and investors use a mix of data and common sense to figure out where we are in the cycle. Important indicators include:

- Gross Domestic Product (GDP): Measures the total value of goods and services produced. Rising GDP usually signals expansion, while falling GDP indicates contraction.

- Employment and wages: High employment and rising wages are typical of expansion; falling employment marks a contraction.

- Interest rates: Central banks often lower rates during recessions to encourage borrowing and raise them at peaks to cool the economy.

- Consumer spending: When people feel confident, they spend more; during recessions, they cut back.

- Stock market indices: Persistent upward trends in indices like the Sensex, Nifty or S&P 500 point toward bull markets.

In the United States, the National Bureau of Economic Research (NBER) is the official body that marks the start and end dates of economic cycles. It measures the length of cycles from peak to peak or trough to trough, using GDP and other indicators. Since the 1950s, the average U.S. cycle has lasted about five and a half years, but this varies widely—from an 18‑month peak‑to‑peak cycle in 1981 to the long expansion that began in 2009 investopedia.com.

Why Do Market Cycles Happen?

Economists debate the causes of market cycles. Some theories, like monetarism, link cycles to changes in the money supply and interest rates. Monetarists believe that when central banks expand the money supply, borrowing becomes cheaper, leading to expansion; when they tighten monetary policy, borrowing becomes expensive, slowing the economy. Keynesian economists argue that fluctuations in aggregate demand and investor sentiment drive cycles; when businesses and consumers become pessimistic, spending drops, causing a downturn.

Investor psychology also plays a significant role. Optimism fuels bull markets while pessimism deepens bear markets. External factors—such as new technologies, changes in government policy, pandemics or wars—can push the cycle into a new phase. For example, the introduction of smartphones and affordable internet helped drive the bull markets of the 2010s, while the COVID‑19 pandemic quickly triggered a global contraction in 2020.

How to Navigate Market Cycles

Knowing that markets move in cycles can help both seasoned investors and beginners make wiser decisions. Here are some friendly tips:

Stay Informed and Keep Learning

Understanding what affects markets—like GDP growth, inflation and employment—can help you recognize where we might be in the cycle. According to Kuvera’s guide, regular research and continuous learning are vital kuvera.in. Read reliable news, follow economic updates and learn basic financial terms. You don’t need to become an economist, but being curious helps.

Diversify Your Investments

Putting all your money into one stock or sector is like planting only one type of crop; if pests arrive, the whole harvest is ruined. Diversification—spreading your investments across different types of assets—reduces risk. The Mydoh guide explains that diversification means holding a variety of investments so that if one falls, others may remain stable mydoh.ca.

Think Long Term

Market cycles can be bumpy in the short term. Focusing on long‑term goals helps investors weather downturns. Kuvera advises maintaining a long‑term perspective to navigate short‑term volatility kuvera.in. This means not panicking when prices drop and remembering that recoveries have always followed recessions in the past.

Keep Cash for Emergencies

During recessions, having a cash reserve can prevent you from selling investments at a loss. Experts suggest building up savings during good times. This safety net helps you pay bills if you lose your job or unexpected expenses arise.

Avoid Trying to Time the Market

Trying to buy at the exact bottom or sell at the exact top is nearly impossible. Even professional investors struggle with timing. Instead, consider dollar‑cost averaging—investing a fixed amount at regular intervals. This strategy reduces the risk of investing all your money right before a downturn and allows you to buy more shares when prices are low.

Match Investments to the Cycle

Some sectors do better at different stages of the cycle. During expansion, technology, financials and consumer discretionary companies often thrive, whereas defensive sectors like healthcare and utilities tend to hold up better during contractions britannica.com. As you learn more, you can adjust your portfolio gradually to take advantage of these patterns, but remember that diversification and a long‑term perspective remain the most important tools.

Conclusion

Market cycles may seem mysterious, but they follow patterns that anyone can understand. Like the seasons or a roller‑coaster, markets go up and down; expansion gives way to peak, contraction leads to a trough and recovery brings new growth. Recognizing these phases helps investors stay calm during downturns and avoid becoming overly excited during booms. Whether you’re in India watching the Sensex or in the United States tracking the S&P 500, the same principles apply. By staying informed, diversifying your investments and thinking long term, you can navigate market cycles with confidence.

The next time someone talks about bull and bear markets, you’ll know why bulls charge ahead and bears take a swipe downward. You’ll also know that after every winter comes spring, and after every trough comes a new opportunity for growth.

One comment on “What are Market Cycles ? Explained for Beginners”